What is 'Risk Parity'

What is 'Risk Parity'

Risk parity is a portfolio allocation strategy using risk to determine allocations across various components of an investment portfolio. The risk parity approach to portfolio management centers around efficient market theory to optimally diversify an investment portfolio among specified assets.

BREAKING DOWN 'Risk Parity'

Risk parity is an advanced portfolio technique often used by hedge funds. It typically requires quantitative methodology which makes its allocations more advanced than simplified allocation strategies. Simplified allocation strategies such as 60/40 are based on holding a percentage of asset classes, such as 60% stocks and 40% bonds, for standard diversification and exposure within one's investment portfolio. In simplified allocation strategies using stocks and bonds, allocations are generally more heavily weighted towards equities for investors willing to take on more risk. Risk averse investors will typically have a higher weight in bonds for capital preservation.

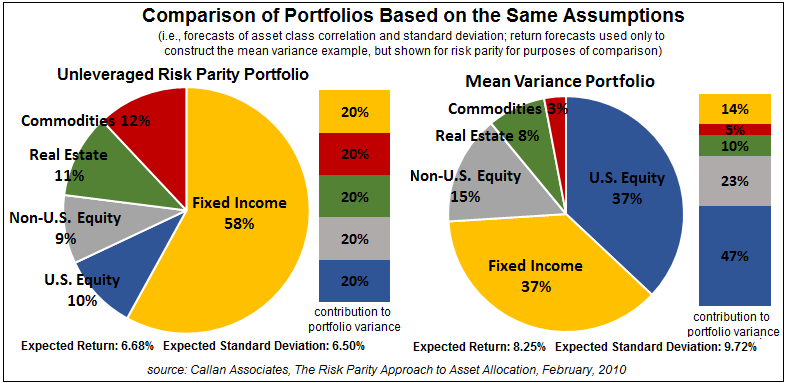

With a risk parity strategy an investment portfolio can include stocks and bonds. However instead of using a predetermined proportion of asset diversification such as 60/40, investment class proportions are determined by risk and return levels. Risk parity strategies have generally evolved and developed from efficient market hypothesis investing. They allow investors to target specific levels of risk and to divide risk across the entire investment portfolio in order to achieve optimal portfolio diversification.

Risk parity strategies allow for alternative diversification in portfolios and funds. In risk parity strategies portfolio managers can use any mix of assets they choose. Risk parity strategies are typically comparable to the optimal point on the efficient frontier, determined by the intersection at which the capital market line and efficient frontier meet. They seek to provide investors with the optimal proportion of investment in specified asset classes based on each asset classes risk. This is often achieved by equal risk weighting across assets classes to determine the proportional mix of capital contributions for the best portfolio return per risk.

With risk parity strategies, portfolio managers can derive exact capital contribution proportions of asset classes in a portfolio to achieve optimal diversification for a range of objectives and investor preferences. The goal of risk parity investing is to earn the optimal level of return for the volatility and risk of the securities involved.

Investing in Risk Parity Strategies

Several risk parity-specific products, including mutual funds, are available, and investors can also build their own risk parity portfolios through careful research or by working with a qualified financial professional. Funds can use an efficient frontier of varying asset classes offering investors multiple options for a diversified portfolios. Many funds diversify among equities, fixed income, currency and commodities.

The first risk parity fund, the All Weather hedge fund, was introduced by Bridgewater Associates in 1996. Since then numerous indexes and funds have been developed with a risk parity focus. Hedge Fund Research is an entity involved in risk parity solutions. They have developed a series of risk parity indexes which include: HFR Risk Parity Vol 10 Index, HFR Risk Parity Vol 10 Institutional Index, HFR Risk Parity Vol 12 Index, HFR Risk Parity Vol 12 Institutional Index, HFR Risk Parity Vol 15 Index and HFR Risk Parity Vol 15 Institutional Index. These indexes achieve a total targeted volatility level.

Other examples of risk parity funds include the AQR Risk Parity Fund (AQRIX) and the Horizons Global Risk Parity ETF (HRA

Read more: Risk Parity | Investopedia https://www.investopedia.com/terms/r/risk-parity.asp#ixzz56WUZ1Kup

Follow us: Investopedia on Facebook

Comments

Post a Comment